A household settlement marks a final phase inside the acquire or sale of the home, wherever ownership is officially transferred in the seller within the consumer. This essential move, typically named "closing," will involve numerous lawful and financial procedures constructed to finish the transaction in accordance with the terms with the sale contract. Household settlements are crucial in sound estate transactions involving houses, apartments, and in addition other dwellings and be certain that Every occasion fulfill their contractual obligations.

Key Features of Household Settlements

Residential settlements need a number of crucial actions, starting from a thorough overview of the sale contract. This settlement outlines the sale conditions, including the cost, funding conditions, and any contingencies, for instance essential repairs or inspection problems. Reviewing these details means that each customer and seller are crystal clear on her or his obligations in advance of proceeding for your transfer of possession.

A different important move in a household settlement is the title lookup. The title search confirms the vendor holds a particular title to the home and identifies any liens, encumbrances, or disputes that could impact the sale. By way of example, unresolved mortgages or unpaid home taxes ought to be settled right before transferring the title for your purchaser. Once the title is verified as crystal clear, the settlement course of action can carry on.

Financial Aspects of Household Settlements

Monetary coordination is crucial to household settlements. Settlement brokers or attorneys insurance plan policy for the transfer of money in the customer check here toward the vendor, typically as a result of escrow accounts, which support the resources securely till all disorders are met. In addition, any existing mortgages for your home have to be repaid, and changes are created for residence taxes, homeowners’ association charges, or electric powered payments, making sure Each and every party settle any exceptional credit card debt precisely.

The settlement process comes with securing funding, if relevant. The client's mortgage organization operates closely with all of the settlement agent making sure that funds is available for the closing. After all monetary prerequisites are fulfilled, the buyer pays closing prices, which may contain expenses for title insurance, inspections, and administrative services.

Finalizing the Transfer of Ownership

Once all contractual and bills are fulfilled, the settlement agent facilitates the transfer of possession insurance policies organizations the consumer and vendor signal necessary documents. These may perhaps insert the deed transfer and shutting disclosure types. After the signing, the agent registers the transaction although applying city, completing the authorized transfer of ownership.

The Position of Settlement Brokers

Settlement agents, often known as conveyancers or closing agents, Participate in an important job in residential settlements. They operate as neutral third parties, running authorized and economic tasks to guarantee a good and compliant transaction. Their expertise is rather beneficial for purchasers and sellers unfamiliar with all of the complexities of house transfers, generating household settlements significantly less nerve-racking furthermore way more uncomplicated.

In sum, household settlements genuinely absolutely are a cautiously coordinated method that finalize the acquisition or sale with the dwelling, making certain the two get-togethers have achieved their obligations knowning that possession is legally transferred without situation.

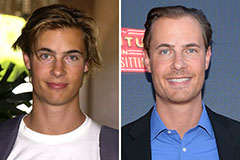

Erik von Detten Then & Now!

Erik von Detten Then & Now! Loni Anderson Then & Now!

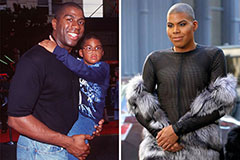

Loni Anderson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!